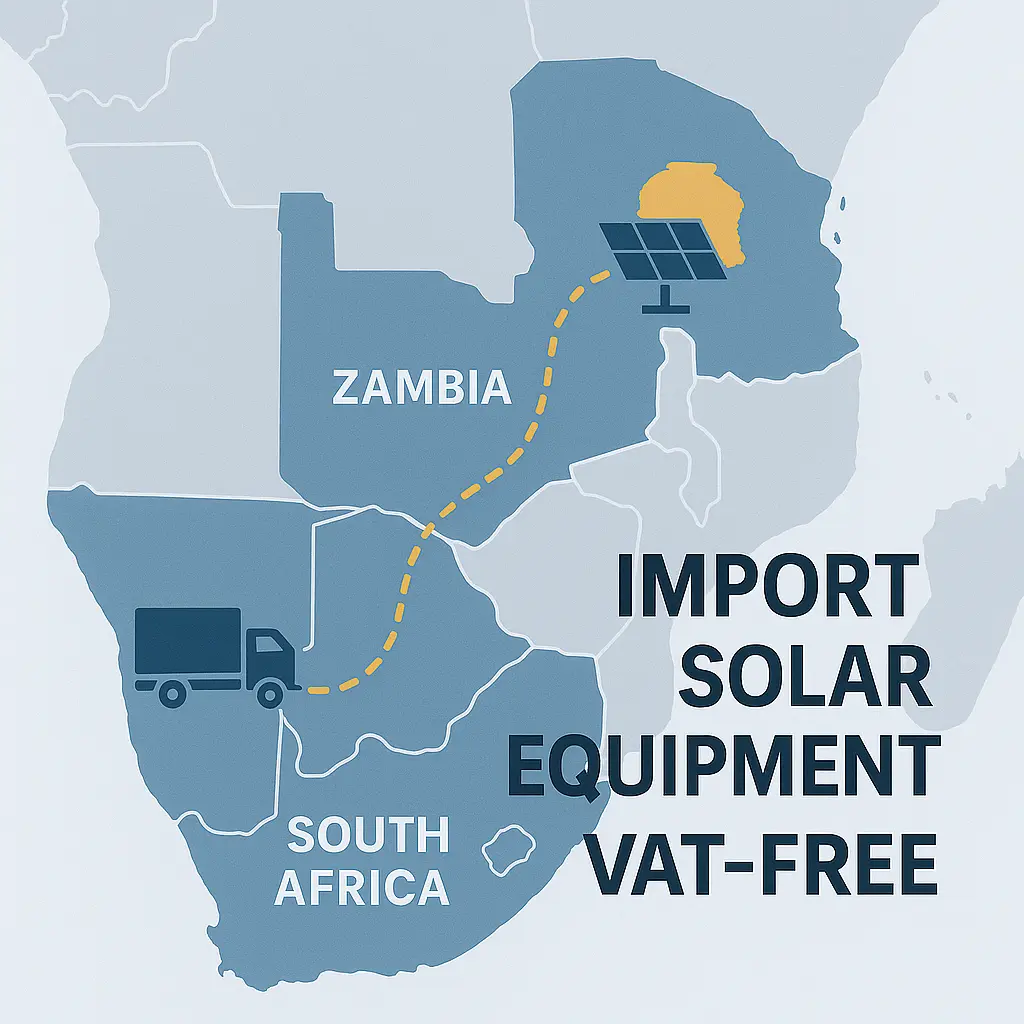

How to Import VAT-Free Solar Equipment from South Africa to Zambia

Key take-away: Structure the sale as a direct export from South Africa (0 % VAT) and declare the goods under Zambia’s zero-rating schedule (0 % VAT). Done correctly, you avoid the combined 31 % VAT normally payable (15 % SA + 16 % ZM).

South-ern Africa’s demand for reliable power keeps rising, and Zambia’s abundant sunshine makes solar the logical choice. Many Zambian businesses and homeowners therefore look south to South Africa—home of competitive pricing and robust supply chains—for their solar hardware.

Yet cross-border deals raise one urgent question: Do I have to pay VAT twice? The answer is no—provided you follow the rules in both jurisdictions. This guide walks you through those rules, shows which products qualify, and explains how GridSolutions SA makes VAT-free importing simple.

Zambia’s VAT Exemption: Zero-Rating for Eligible Solar Equipment

Zambia promotes renewable energy through Statutory Instrument 104 of 2021 (building on SI 33 of 2008). The schedule lists key solar components at a zero VAT rate (0 %)—crucially different from “exempt” goods because VAT-registered businesses can still claim input credits.

Which products qualify?

| Product category | Typical HS Code* | Notes |

| Solar PV panels | 8541.43.00 | All wattages and formats |

| Lithium-ion & other solar batteries | 8507.60.00 / 8507.80.00 | Li-ion added to zero-rating in 2023 |

| Solar inverters (static converters) | 8504.40.00 | Includes hybrid & off-grid units |

| Charge controllers | 8537.10.00 | MPPT & PWM types |

| Solar water heaters / geysers | 8419.12.00 | Vacuum-tube & flat-plate |

| Complete solar street-lights, DC pumps | 9405.41.00 etc. | Must be integrated solar units |

*Confirm codes with your clearing agent—HS updates occur annually.

Because the zero rate applies at import, ZRA should record no Import VAT—saving you 16 % immediately and enabling tax-registered firms to keep their input-credit rights.

South Africa’s Side: Zero-Rating Solar Equipment for Export

South Africa taxes goods where they are consumed (“destination principle”). Items shipped abroad qualify for 0 % VAT—but only if you pick the correct export method.

1. Direct export (recommended)

- GridSolutions SA (or its carrier) delivers the consignment outside SA borders.

- Invoice shows 0 % VAT.

- Supplier keeps proof of export: SAD 500, transport docs, signed delivery receipt.

2. Indirect export (self-collection)

- Zambian buyer collects from SA premises.

- Supplier must charge 15 % VAT.

- Buyer claims a refund at the border within 90 days of invoice—strictly enforced by SARS.

- Extra paperwork and cash-flow drag; use only when logistics demand self-collection.

Does It Apply to You? — B2B vs B2C Imports

| Importer type | Requirements at Zambian border | VAT outcome |

| Businesses (resale, projects, own sites) | ERB import licence + product quality certs | 0 % SA export VAT + 0 % ZM import VAT |

| Individuals (home or farm systems) | ERB/ZRA Self-Declaration form (non-commercial) | Same 0 % / 0 % treatment |

Both groups enjoy the same tax break; only the paperwork differs.

Step-by-Step Guide to VAT-Free Importation

1 Choose an export-ready supplier

GridSolutions SA structures transactions as direct exports and issues VAT-free invoices.

2 Confirm product eligibility

Match each item’s HS code to the zero-rated list before payment.

3 South African export paperwork (supplier)

- VAT-free commercial invoice

- SAD 500 customs export declaration

- Packing list & transport documents

4 Prepare the Zambian import file (importer/agent)

- Commercial invoice & packing list

- Transport docs (road manifest / bill of lading)

- ERB import licence or Self-Declaration form

- Product quality certificates (where required)

5 Lodge the import declaration

Licensed clearing agent cites the correct SI number when completing the entry.

6 Customs verification & release

ZRA verifies docs, may inspect cargo, then clears goods without charging 16 % VAT.

Quick checklist: invoice • SAD 500 • HS codes • ERB licence / declaration • clearing agent briefed.

Why GridSolutions SA Is Your Ideal Partner

- Cross-border expertise – We handle direct-export paperwork daily.

- Eligible product range – Tier-1 panels, Li-ion batteries, hybrid inverters, MPPT controllers.

- Zambia pick-up option – Collect at our Lusaka hub for faster last-mile delivery.

- Competitive pricing – South African cost base without the VAT uplift.

- Hands-on support – We liaise with your clearing agent to pre-clear every shipment.

Need a VAT-free quote?

Call our Zambia Exports Desk on +27 11 xxx xxxx or email [email protected].

Important Considerations Beyond VAT

- Customs duty – Solar panels now 25 % of CIF value (before VAT); batteries/inverters often 0–5 %.

- Logistics costs – Freight, insurance, port fees and agent charges still apply.

- Regulatory compliance – ERB permits, SADC certificates and product standards must be met.

Regulations change each budget cycle—always check the latest ZRA, ERB and SARS notices or consult a customs professional.

Conclusion: Simplify Your Solar Imports with GridSolutions SA

Correctly harnessing Zambia’s zero-rating and South Africa’s export rules can chop 31 % off your landed price. With GridSolutions SA you gain not only top-quality solar gear but the expertise to move it across the border VAT-free and hassle-free.

Ready to cut costs and power up? Request your zero-rated invoice »

Disclaimer

This guide reflects public regulations as at 14 May 2025. Tax laws change; seek advice from ZRA, SARS or a qualified customs-tax professional for your specific shipment.